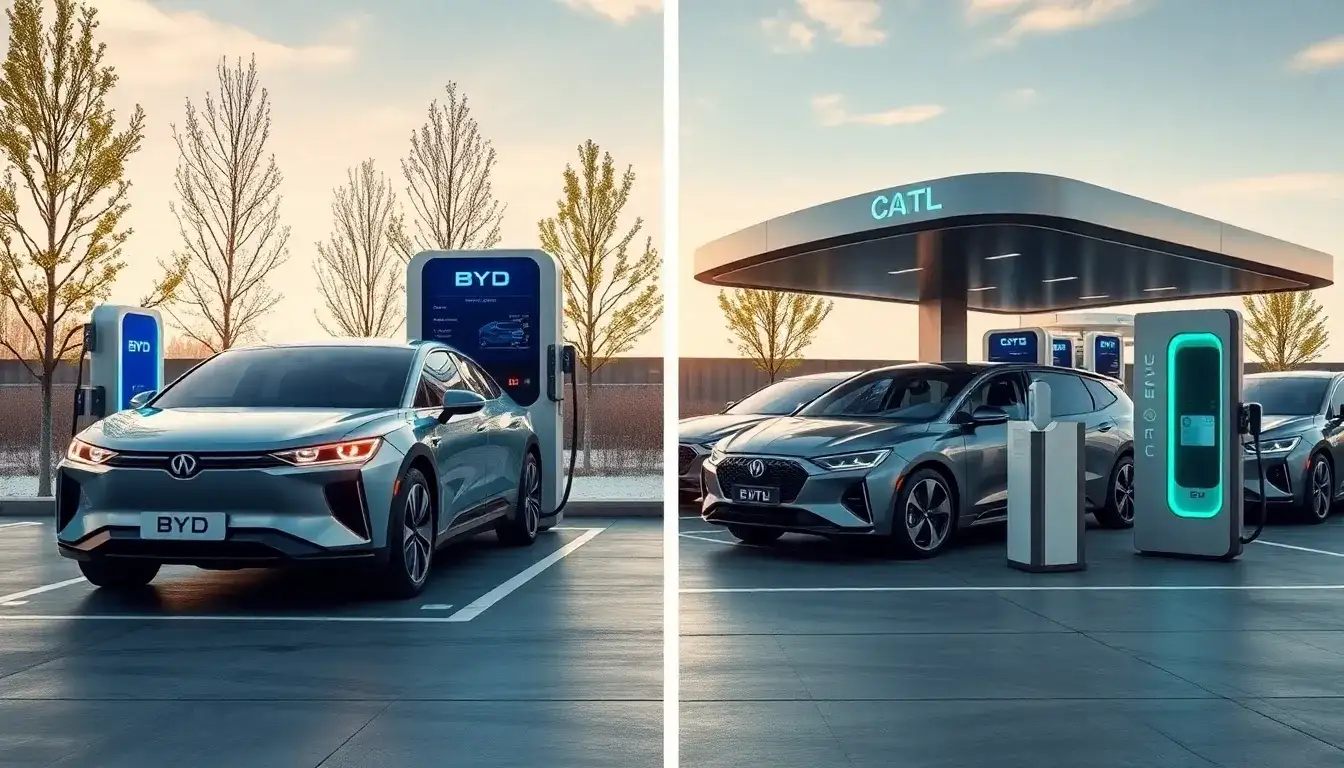

The competition in the electric vehicle charging and battery-swapping market is intensifying, with major companies vying for market leadership. On March 17, BYD officially launched its “Megawatt Flash Charging” technology during the unveiling of its Super e platform and the pre-sale of its Han L and Tang L models. BYD’s Chairman, Wang Chuanfu, stated that this technology is the world’s first mass-produced passenger vehicle high-voltage architecture capable of supporting charging rates up to 10C and maximum charging power of 1MW (1000 kW). He emphasized that this is the industry’s first breakthrough into the “megawatt era” of electric vehicle charging power.

On the same day, CATL formed a significant partnership with NIO, signing a strategic cooperation agreement to create the world’s largest and most advanced battery-swapping service network for passenger vehicles. The agreement highlights their intention to leverage their respective strengths in technology, management, platforms, and branding to accelerate the development and promotion of battery-swapping networks in line with the global automotive industry’s transition.

Bai Wenxi, Vice Chairman of the China Enterprise Capital Alliance, noted to China Business News that charging and battery swapping are not mutually exclusive; rather, they complement each other. Companies should balance their investments in both areas according to their technological capabilities, market positioning, and consumer demands. “BYD has made significant breakthroughs in charging technology with its ‘Megawatt Flash Charging’, but this does not mean it will abandon exploration in the battery-swapping arena. Likewise, while CATL and NIO are focusing on battery-swapping infrastructure, they are also attentive to the development of charging technologies. Companies can utilize fast-charging technologies to enhance user experiences and alleviate ‘range anxiety’, while capitalizing on the advantages of battery swapping in high-frequency usage scenarios, such as taxis and buses, as well as among users who require rapid energy replenishment. By developing charging and battery swapping distinctly, companies can establish a more competitive energy replenishment system in the new energy market,” Bai stated.

Accelerating Market Entry into Charging and Battery Swapping

On the evening of March 17, BYD introduced its new Super e platform, promoting the slogan “Oil and Electricity at the Same Speed”, aiming to make electric vehicle charging times comparable to the refueling times of gasoline vehicles. This platform features flash charging batteries, motors that operate at approximately 30,000 revolutions per minute, a 1000-volt voltage platform, and a megawatt-level flash charging system, marking a significant advance for BYD in the fast-charging sector. BYD plans to establish over 4,000 megawatt flash charging stations nationwide and will open its technology to social capital to collaboratively promote the construction of charging networks.

On the same night, the two giants in the battery-swapping field also took swift action. On March 18, CATL and NIO announced they had signed a strategic cooperation agreement to jointly develop the world’s largest battery-swapping network and promote unified industry technology standards. The agreement will deepen the sharing of battery swapping networks based on standardized batteries and promote the popularization and upgrading of battery-swapping services. CATL will support the development of NIO’s battery-swapping network, and new models developed under NIO’s Firefly brand will be compatible with CATL’s chocolate battery-swapping standards and network. The battery-swapping networks of both companies will adopt a “dual-network parallel” model to enhance user experience. Additionally, CATL and NIO will jointly work on formulating and promoting national standards for battery swapping, enhancing compatibility across brands and vehicle models, and building a complete industrial chain from battery research and development to battery asset management and recycling.

Under this cooperation framework, CATL plans to invest up to 2.5 billion yuan in NIO Energy to deepen their collaboration in the battery-swapping sector. Currently, the battery-swapping market in China is primarily dominated by NIO and CATL, leading to the formation of two major battery-swapping alliances. The main members of the NIO battery-swapping alliance include GAC, Changan, Geely, Chery, and FAW Group, while CATL’s alliance consists of GAC Aion, BAIC, Wuling, and Changan.

The battery-swapping model is favored for its speed, which is comparable to conventional refueling, and its significant convenience. As a result, both NIO and CATL have invested heavily in this sector to expand their market share. To boost its battery-swapping business, CATL has established a dedicated battery-swapping company, Times Electric Service. The plan is to build 1,000 battery-swapping stations this year, initially constructed independently by Times Electric Service; the mid-term goal is to establish 10,000 stations, which will be built in partnership with ecological collaborators; the ultimate target is to build 30,000 stations, matching the current number of gas stations nationwide and involving social capital for joint construction.

Meanwhile, NIO has continued to invest in battery swapping despite ongoing losses. So far, NIO has established 2,427 battery-swapping stations nationwide. NIO’s Chairman, Li Bin, stated that achieving the goal of 6,000 battery-swapping stations to cover 6 million users will require an investment of at least 15 billion yuan, implying an average cost of about 2.5 million yuan per station. However, the substantial investment and profitability challenges of the battery-swapping model have made collaboration between NIO and CATL almost inevitable.

Battery swapping and fast charging are two mainstream energy replenishment methods for electric vehicles, each with its own advantages and challenges. The fast-charging camp generally believes that the battery-swapping model faces compatibility issues, making large-scale market promotion difficult; in contrast, the battery-swapping camp argues that charging and battery swapping are not alternatives but can achieve complementary advantages. In a highly competitive industry, how companies balance their development between fast charging and battery swapping is a focal point of market attention. Economist and new finance expert Yu Fenghui pointed out that with the simultaneous advancement of megawatt-level fast charging and battery-swapping service networks, electric vehicle manufacturers should make differentiated investments and layouts based on market demand and technological maturity. For urban users, megawatt-level fast charging can provide a convenient experience similar to refueling, meeting the demand for quick energy replenishment, while battery-swapping technology is better suited for operational vehicles and long-distance transportation scenarios, enhancing vehicle operational efficiency. Thus, companies need to craft targeted strategies for different market segments and maintain a balance in technology research and development, market promotion, and resource allocation to achieve sustainable market competitiveness.

Performance Divergence and Intense Competition in the Charging and Battery Swapping Market

Despite the escalating competition between BYD and CATL in the charging and battery swapping market, there is a noticeable divergence in their performance. On March 24, BYD released its 2024 annual report, showing robust growth. The company achieved a revenue of 777.102 billion yuan in 2024, a year-on-year increase of 29.02%, and a net profit attributable to shareholders of 40.254 billion yuan, up 34.00%. All core operational metrics reached historic highs, demonstrating BYD’s steady growth in the global electric vehicle market. In the domestic market, BYD has accelerated its launch of new models and optimized its product structure to precisely meet the increasing consumer demand for new energy vehicles, continuously driving up its market share. In the overseas market, the company is enhancing its brand recognition while achieving breakthroughs in multiple regions, further consolidating its competitiveness in the global electric vehicle market.

BYD’s sustained growth is closely linked to its high investment in technological innovation. In 2024, the company invested 54.2 billion yuan in R&D, a 36% increase, far exceeding its net profit during the same period. Over the 14 years from 2011 to 2024, BYD’s R&D expenditure exceeded its net profit in 13 of those years, reflecting the company’s firm commitment to technological innovation and long-term strategic vision. This ongoing high R&D investment not only bolsters BYD’s technological advantages in batteries, power systems, and intelligence but also lays a solid foundation for its future market competitiveness.

In stark contrast, CATL’s performance has shown a different trend. According to CATL’s 2024 annual report, the company recorded a revenue of 362.012 billion yuan in 2024, a year-on-year decrease of 9.7%, while net profit attributable to shareholders was 50.744 billion yuan, an increase of 15.01%. The revenue decline is attributed to adjustments in battery product prices. CATL explained in its performance forecast that although the sales of its battery products increased, prices were lowered due to a decrease in raw material costs, such as lithium carbonate, resulting in a year-on-year decline in revenue. However, the increase in gross margin supported profit growth. In 2024, CATL’s gross margin for power battery systems was 23.94%, an increase of 5.81 percentage points, while the gross margin for energy storage battery systems was 26.84%, up 8.19 percentage points. Although the gross margins for battery materials and recycling and the battery mineral resources business declined, these segments together account for less than 10% of overall revenue, limiting their impact on profitability.

The market swiftly reacted to the performance divergence of the two companies. BYD’s market value has surpassed that of CATL. As of the close on March 28, BYD’s stock price fell by 1.03% to 382.5 yuan per share, with a market value of 1.15 trillion yuan; during the same period, CATL’s stock price also dropped by 0.8% to 256.8 yuan per share, with a market value of 1.13 trillion yuan. BYD ranked ninth in the A-share listed company market value list, while CATL ranked eleventh. Based on the closing prices, BYD’s market value is approximately 20 billion yuan higher than CATL’s. This marks the first time since June 15, 2018, that BYD has outperformed CATL in market value, reflecting the capital market’s recognition of BYD’s strong growth potential.

Nevertheless, the competition in the charging and battery swapping market remains challenging for both BYD and CATL. The expansion of megawatt-level charging technology and battery-swapping networks is crucial not only for improving energy replenishment efficiency but also for balancing grid loads and reducing infrastructure costs. Yu Fenghui pointed out that governments, enterprises, and grid operators need to coordinate closely to promote the healthy development of the charging and battery swapping market. Governments can accelerate the layout of charging piles and battery-swapping stations through planning and financial support; enterprises should focus on technological innovation to enhance charging efficiency and reduce pressure on the grid; while grid operators should optimize grid management and adopt smart grid technologies to balance loads. Additionally, exploring time-based electricity pricing mechanisms could encourage users to charge during off-peak periods, further alleviating supply pressures during peak times. Only through the joint efforts of governments, enterprises, and grid operators can the new energy vehicle industry achieve sustainable development.